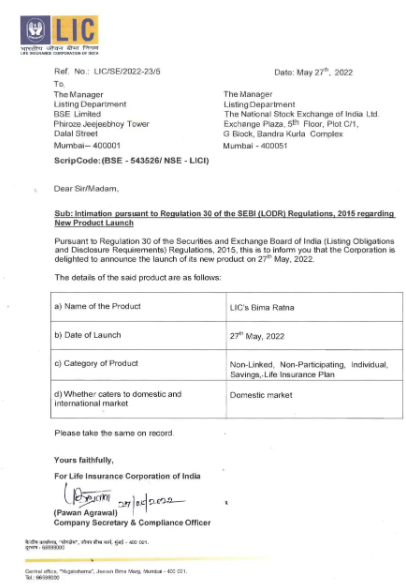

LIC has launched a new policy Bima Ratna on 27th May. It is a non-linked, non-participating, individual, savings life insurance plan. At that time the price of LIC share was Rs.820.85.

Life Insurance Corporation of India, the country’s largest insurer, has launched a new policy on Friday, 27 May 2022. LIC has launched a new policy named Bima Ratna. The insurance company has informed the stock exchange about the new policy. As per the information given in BSE, LIC Bima Ratna Policy is a non-linked, non-participating, individual, savings life insurance plan. Let us tell you that the stock of LIC has been listed in the stock market on May 17. The stock got listed at Rs 872 level against the issue price of Rs 949.

The next week was 30 May 2022 LIC board meeting. In this meeting, the March quarter results were announced and the company also considered paying dividend, LIC’s IPO is 13 percent below the issue price. LIC share price closed at Rs 8210.50 on BSE on Friday.

In the information given to the stock exchange, LIC had said that on May 30, the company will announce the results regarding audited results, quarterly results and the performance of the company in the entire financial year. If the board of directors of the company decides to pay the dividend, then it can be announced on the same day.

Government gets Rs 20,560 crore from LIC IPO

For LIC, the government had kept the price band of Rs 902-949, with the necessary applications being received at the upper levels, the government had kept the issue price at Rs 949. Through the issue, the government raised Rs 20,560 crore by selling 3.5 per cent stake. The entire IPO was subscribed almost 3 times. The issue received an overwhelming response from domestic investors. However, the response from foreign investors was mixed. For this reason, there has been a decline in its gray market premium along with the issue and the gray market premium has become negative after the issue is closed.

This benefit will also be available in the long term

After the LIC listing (DIPAM Secretary Tuhin Kant Pandey had said that the country’s largest insurance company LIC had a weak start due to unforeseen market conditions. He suggested investors to sell LIC’s stock to get benefits in the long term. They should be kept. Pandey had said that no one can predict the stock market. We say that it (LIC shares) should be kept for a long period, not for a single day.